In today’s fast-paced financial landscape, robust security measures are not optional — they are essential. Financial services organizations face a constant onslaught of fraud attempts that threaten both their bottom line and the trust of their customers. That’s where real-time AI-powered fraud detection comes into the picture. Think of it as a game-changing solution designed to safeguard transactions and maintain customer confidence.

Harnessing the power of AI, financial services teams can rapidly identify and neutralize fraudulent activities before they cause harm. In this blog post, we’ll dig into how AI is revolutionizing fraud detection. Then, we’ll share actionable tips on how to safeguard transactions with the assistance of AI.

The Growing Threat of Financial Fraud

According to the FTC, there were 2.6 million fraud reports in 2023, marking an increase from 2022. Additionally, $10 billion was lost to fraud in 2023.

This escalating threat impacts not only consumers but also financial institutions. With the widespread adoption of digital banking and online transactions, cybercriminals have become more sophisticated, continually developing new methods to exploit vulnerabilities. Consequently, traditional security measures are no longer sufficient. Financial services institutions must enhance their protective measures, and AI has emerged as a crucial tool in meeting this need.

Why Prioritize Financial Fraud Detection

With financial fraud, real-time detection is indispensable. Leveraging technology that alerts organizations the moment fraud occurs allows teams to mitigate the impact before it escalates. This approach not only minimizes potential financial losses but also instills customer trust in the organization, preventing a tarnished reputation.

By prioritizing the safeguarding of financial transactions, your organization can effectively prevent these repercussions, maintaining both financial stability and customer confidence.

How AI is Upleveling Fraud Detection to Safeguard FinServ Transactions

Financial services organizations can leverage advanced machine learning (ML) algorithms and deep learning models to analyze vast amounts of transactional data in real time. These AI systems employ sophisticated pattern recognition techniques to immediately flag anomalies that deviate from established behavioral norms.

Furthermore, AI integrates data from multiple sources, including transaction histories, device metadata, and geolocation information, constructing comprehensive profiles for each user. This multi-faceted approach allows organizations to identify fraudulent activity with high precision and speed. Thanks to this speed, your team is able to act swiftly and decisively the moment potential activity is detected.

Better yet, AI-powered systems utilize neural networks for continuous learning and adaptation to emerging fraud tactics, which enhances predictive accuracy over time. The combination of continuous learning and real-time monitoring capabilities enables AI to swiftly flag and mitigate potential fraud, reducing both false positives and the overall impact of fraudulent transactions.

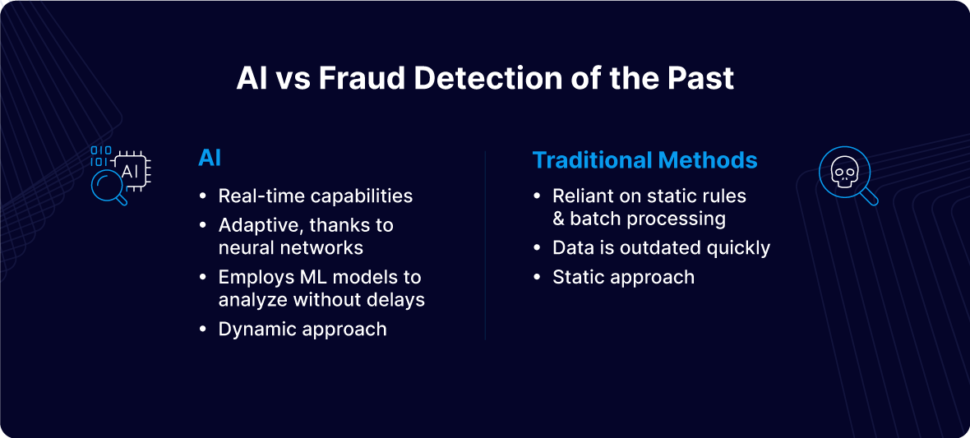

AI vs Fraud Detection of the Past

The utilization of AI in fraud detection efforts signifies a tremendous improvement over traditional techniques. This can largely be attributed to AI’s real-time capabilities and adaptive nature due to neural networks which learn. Unlike antiquated systems reliant on static rules and batch processing which rapidly becomes outdated, AI employs ML models capable of analyzing transactions with no delay. This empowers real-time analysis and, as a result, instantaneous detection of suspicious activities, empowering financial institutions to swiftly intervene and thwart fraudulent transactions.

Moreover, AI systems continuously refine their algorithms through iterative learning processes. As systems adapt to emerging fraud tactics, detection accuracy improves even as thieves’ methodology evolves. This adaptive capability is facilitated by neural networks, which enable AI to autonomously adjust detection parameters based on evolving fraud patterns.

This approach, best described as dynamic, stands in stark contrast to rigid rule-based systems, which lack the adaptability to adjust to the constantly-evolving landscape of fraudulent activities.

How to Safeguard FinServ Transactions with AI

An effective approach involves harnessing a data integration platform that not only facilitates the ingestion, processing, analysis, and visualization of data in real time but also enables seamless streaming of data from diverse sources. This capability empowers teams to extract actionable insights promptly and make swift decisions in response to suspected fraudulent activities.

That’s where Striim comes into play. It is the quintessential solution for safeguarding FinServ transactions as it stands out by seamlessly integrating predictive analytics with real-time data processing. The result is immediate, robust fraud detection capabilities. Compatible with an array of source databases, including Oracle, SQL Server, MySQL, MongoDB, and more, Striim ensures the swift ingestion of data, empowering financial institutions to monitor transactions with unparalleled precision.

At the core of Striim’s effectiveness lies its utilization of advanced machine learning models, enabling real-time analysis of transactional data streams. This empowers teams to proactively detect anomalies and suspicious patterns, enabling swift and decisive risk mitigation. Furthermore, Striim harnesses Change Data Capture (CDC) technology, a pivotal component enhancing its capabilities.

By selectively capturing and replicating changes made to source data, Striim minimizes latency and resource utilization. This offers an optimized approach that ensures efficient data processing, contributing significantly to the platform’s success in real time fraud detection.

Furthermore, Striim’s predictive analytics functionality adds another layer of security by allowing organizations to anticipate potential fraud before it materializes. This proactive intervention capability is highly valued by financial services institutions seeking to stay ahead of emerging threats and safeguard the integrity of their operations.

Take Fraud Detection to the Next Level

Thieves are getting more innovative and, consequently, your fraud detection techniques need to level up, too. Get a free trial of Striim today to discover how real-time data analytics and streaming can unlock insights that help your team preserve your customers’ trust, maintain your business’s reputation, and protect against financial losses.